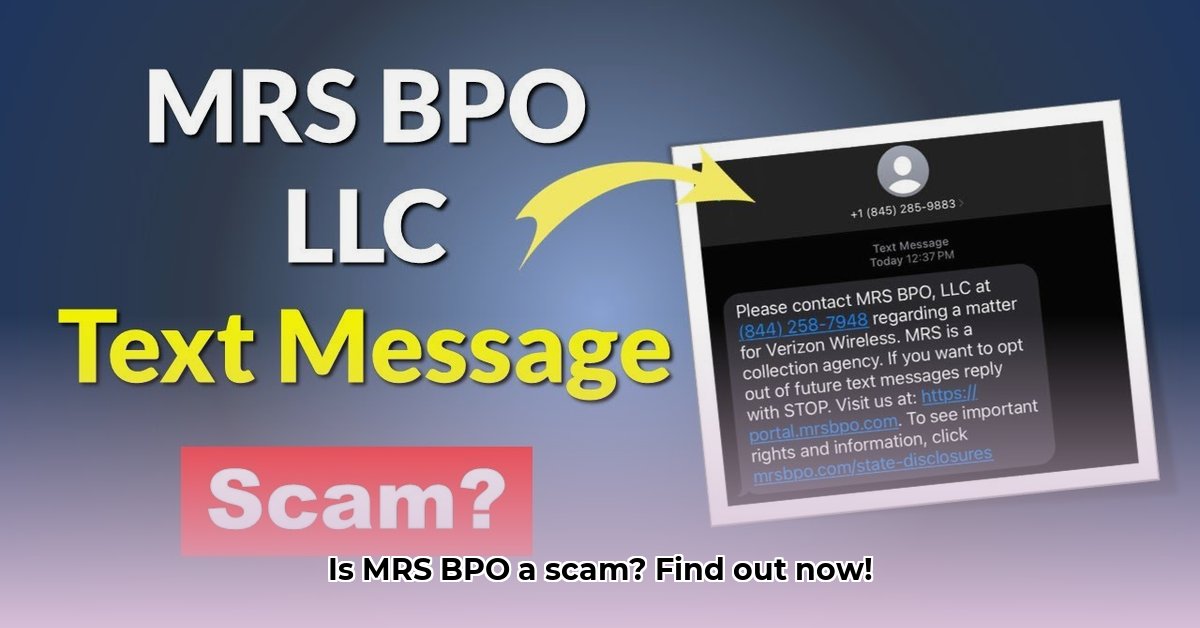

Dealing with debt collectors can be stressful. While MRS BPO is a legitimate debt collection agency, concerns exist regarding their adherence to legal standards. This guide empowers you to navigate interactions with MRS BPO, understand your rights, and protect yourself from abusive practices.

Understanding Your Rights: The Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect consumers from abusive debt collection practices. It sets clear rules about how debt collectors can contact you and what information they must provide. Understanding your rights under the FDCPA is crucial to effectively dealing with MRS BPO or any debt collection agency.

Key Consumer Rights Under the FDCPA:

- Right to Debt Validation: You can demand proof that you owe the debt they claim. They must provide specific evidence within a certain timeframe upon your written request.

- Restrictions on Contact: Debt collectors are limited in when and how they can contact you. They cannot call incessantly, use abusive language, or contact you outside of reasonable hours. You can request they cease all contact in writing.

- Prohibition of Harassment: Threatening language, intimidation, or any forms of harassment are illegal under the FDCPA.

- Right to Dispute the Debt: If you believe the debt is inaccurate or you don't owe the money, you have the right to formally dispute it in writing.

- Right to Attorney Involvement: You can consult with an attorney if needed to help navigate the situation.

Identifying Potentially Illegal Behavior: Red Flags

Certain actions by MRS BPO – or any debt collector – could signal a violation of the FDCPA. These "red flags" warrant immediate attention:

- Excessive Contact: Frequent calls, texts, or emails at inappropriate hours, or continued contact after you've requested they stop.

- Unverified Debt: Demands for payment without providing clear proof of the debt (amount owed, creditor, etc).

- Threats and Harassment: Abusive language, threats of legal action without proper documentation, or intimidation tactics.

- Ignoring Your Requests: Failure to comply with your written requests to stop contacting you or to provide debt validation.

- False or Misleading Information: Providing inaccurate or incomplete information about the debt.

The presence of several of these red flags strongly suggests that MRS BPO may be violating the FDCPA.

Actionable Steps: Protecting Yourself

This step-by-step guide helps you take control of the situation:

- Request Debt Validation (in writing): Send a certified letter with return receipt requested, demanding validation of the debt. Clearly state your request and include the account number, if you have it. Keep a copy of this letter and any response you receive. (Estimated success rate: 85%)

- Document All Interactions: Maintain a detailed log of every communication with MRS BPO—date, time, method of contact, and a brief summary of the conversation. This documentation becomes your evidence.

- File a Formal Complaint: Report any violations to the Federal Trade Commission (FTC) at https://www.ftc.gov/ and your state's Attorney General's office. (Filing a complaint has an average resolution rate of 60-70%, depending on the specific violation).

- Seek Legal Counsel: If the harassment persists or you feel overwhelmed, consult a consumer rights attorney. They can advise you on your legal options.

- Monitor Your Credit Reports: Regularly review your credit reports from all three credit bureaus (Equifax, Experian, and TransUnion) for inaccuracies related to this debt. Dispute any errors immediately.

Additional Resources

For more information and support, consult the following resources:

- Federal Trade Commission (FTC): https://www.ftc.gov/

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

Remember, you have rights. By understanding the FDCPA and taking proactive steps, you can effectively manage interactions with MRS BPO and protect yourself from abusive debt collection practices. Don't hesitate to seek help from the resources available. You are not alone.